WHO ARE WE?

Sunny

Founder AutoBestCars and working with cars is my passion. With this showroom, I converted my passion into my business. With god's grace and customer's support, we have scaled new highs year on year. Transparency and Trust are the keywords for us.

Hunny

Founder AutoBestGrew up watching luxury cars, we always dreamt of owning one myself. Little did I know that our dream would take this shape. Now our only passion is to convert other's dreams of owning a premium car into reality.

Happy Clients

Years Experience

Satisfaction Rating

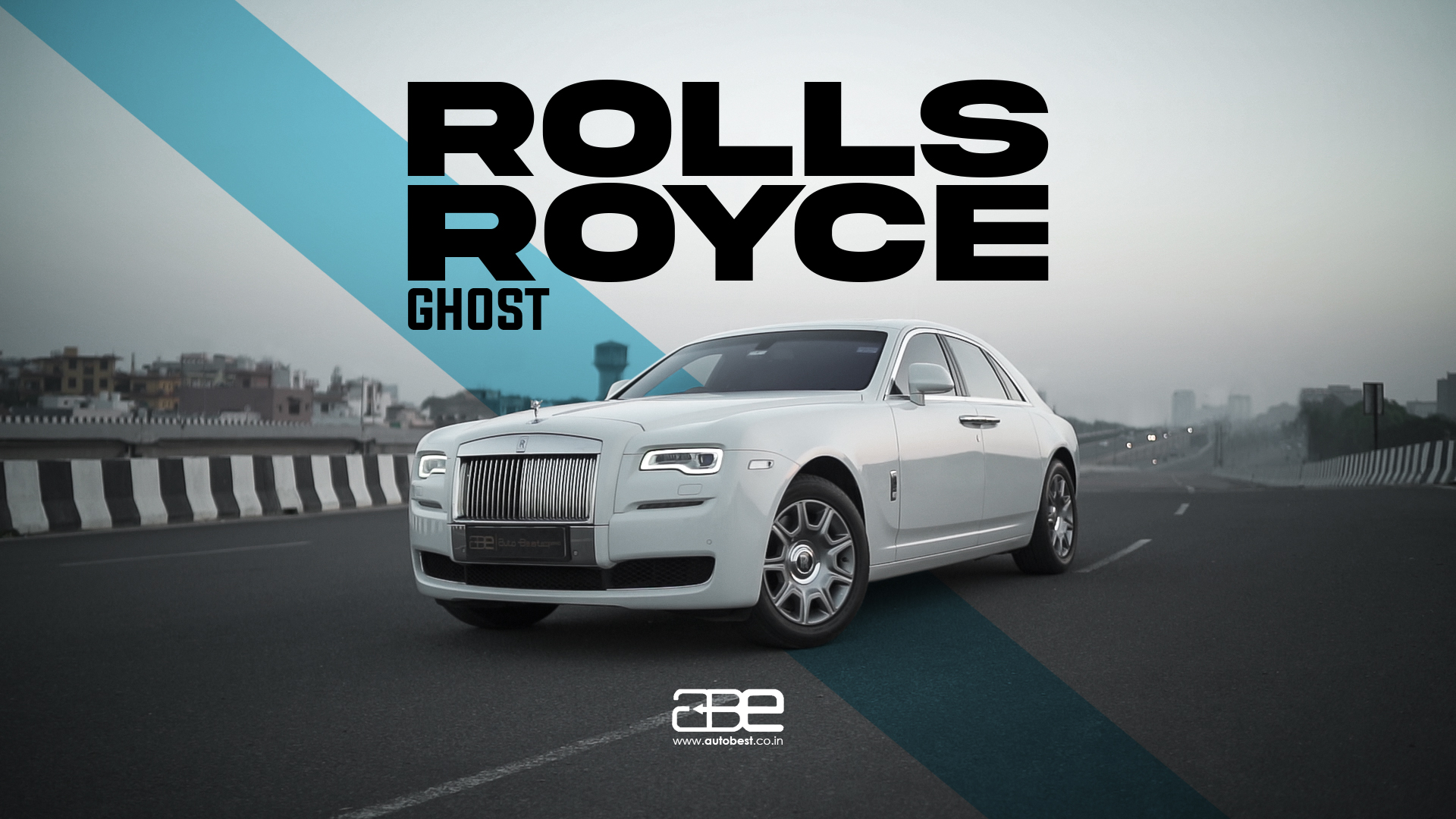

Explore Our Meticulously Curated Inventory of Prestigious Preowned Vehicles.

Schedule a Consultation or Visit Our Showroom Today.

SELL YOUR CAR

PLANNING to

Sell your car?

KNOW WHY SELLING TO US

WILL GIVE YOU THE BEST VALUE.

Best Value Guaranteed

Instant Payment

Sell Car in a Single Visit

Free RC Transfer